India, Jan. 8 --

Summary:The shift from traditional paper-based trading to online demat accounts has simplified the whole process of buying and selling stocks. This tech revolution has been a key driver in growing investor interest, as Google searches for demat and trading have risen alongside. From small cities to searches in regional languages, consumer behavior in this demat market is an investment revolution.

India’s demat market size has experienced significant growth in March 2024. It surpassed 150 million users for the first time- despite market ups and downs. This positive demat account growth in India indicates a growing interest in direct equity investing among new investors.

This user milestone reflects the changing landscape of the trading and investment market. With more individual investors entering the industry and with increased options of stocks in the market, demat trends in India are starting to get interesting.

Traditional Trading Methods in the Demat Industry

India’s come a long way from when investors had to file physical share certificates and paperwork for every share they bought. This process posed day-to-day challenges, including delays in transactional work, risks associated with handling physical documents and paper, and limited accessibility for investors.

However, with the advent of dematerialization in 1991, the investment landscape revolutionized the whole process. Dematerialization introduced the concept of holding securities in electronic form. This transition from paper to digital simplified whole trading processes, eradicated security concerns, and encouraged Indian investors to participate more in the investment market.

Indian Demat Industry: The Rise of Modern-Day Online Trading Platforms

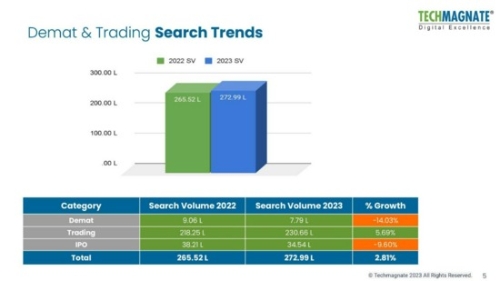

In current times, technology has become an integral part of driving investment accessibility. Information or any service is just one click away. In 2023 alone, there were 272.99L searches for demat and trading on Google.

This surge in investors’ interest in demat and trading is a reflection of how potential investors are looking to make sound decisions when it comes to making financial choices. For instance, more and more people are looking for stock trading apps and downloading them. People are taking their financial futures into their own hands.

A report on the Demat and Stock Trading Trends Report, released by one of the top digital marketing agencies in Delhi , shares how investor search has also evolved with time and convenience. Today, people search with specific keywords for specific brands and apps for trading information and services. For instance:

Investors searched heavily for renowned industry players like Zerodha or ICICI Direct.

The most common search terms used for gathering information about the industry are "stock trading" or "Demat account."

Major cities like Delhi, Mumbai, Lucknow, and Jaipur look for demat-related information the most.

Adani Enterprises and Suzlon were the most searched-for stocks in 2023.

These are just a few of the search-related consumer insights for the demat and trading industry. The full report contains a plethora of data and statistics for understanding demat trends from an investor perspective.

Indian Demat Market: The Next Phase of Investment Evolution

1. Investors want effective apps

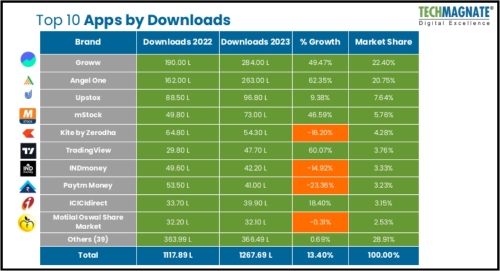

More and more people have started to rely on apps now for their financial requirements. In just one year (2022 - 23), downloads for trading apps grew by 13.40%.

Sarvesh Bagla, CEO of Techmagnate shared his thoughts on demat trends driven by the growing interest in mobile apps among investors.“Groww experienced a 49.47% increase in downloads, while Angel One saw a 62.35% surge. These numbers demonstrate the growing reliance on apps for accessing investment opportunities and managing portfolios. If brands want to build a strong digital presence, understanding customer behavior through these search insights shouldn’t be ignored”.

2. Demat accounts gain traction in Tier-2 and Tier-3 cities

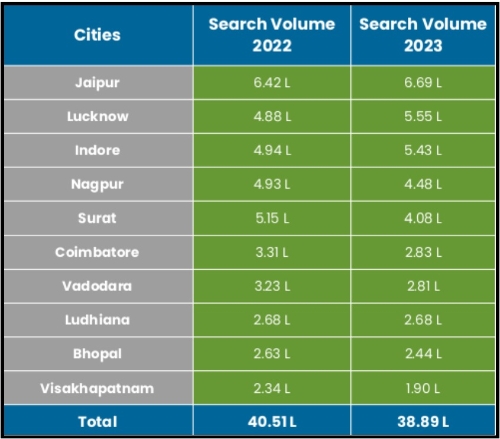

Data from the report shows an increase in online searches for demat accounts and trading options in smaller Indian cities, indicating a proactive approach from investors in these areas increasingly looking to participate in the stock market.

Tier-2 cities like Jaipur, Lucknow, and Indore lead the chart with the highest search volumes.

The reason behind this spike in interest is driven by a more aware and educated consumer. According to Bagla, the availability of demat and trading apps also encouraged users to try their hands at online trading. “Fintech is the real revolution here. What’s stopping people from downloading a trading app and trying their luck with small amounts for trading? The element of true democratization here is undeniable - and irresistible.”

This trend highlights the growing financial literacy and investment appetite in suburban and even rural India - which will continue to grow with time.

3. Investors embrace information in vernacular languages

How small-city investors seek demat & stock trading information is different from the way city dwellers do. Not everyone is comfortable with the English language, especially if it includes financial jargon.

Access to information in vernacular languages like Hindi, Tamil, Telugu, and Marathi further encourages the exploration of investment opportunities.

Brands that embrace vernacular searches can bridge the language gap and empower a new generation of investors in India's smaller cities.

It’s 2024 and India's financial scene is evolving rapidly. New players are entering the trading industry and they’re shaking things up for the better. In the current wave, It'll be interesting to see how the current top players adapt and maintain their positions - and continue being a leading choice among investors. Either way, we’re looking at an exciting time.

While the collective is watching the market, Fintech brands and AMCs need to watch how their audience segments are behaving and start solving their problems. The stocks and trading industry can sharpen their digital strategies by keeping a close watch on emerging trends in the demat industry.

For a closer look into how Indians are behaving in this investment revolution, check out the Demat and Stock Trading Trends Report from Techmagnate - a leading digital marketing agency. The report offers data and insights from investors' perspectives and helps identify the best ways for brands to elevate their online presence, expand their reach, and establish themselves as trustworthy trading platforms.

Download the Demat and Stock Trading Trends Report from Techmagnate.

Want to get your story featured as above? click here!

Disclaimer: This is a Press Release distributed by HT Syndication. For queries write to contentservices@htdigital.in